Every year people across the country wait for the budget. To some extent, the future of students coming from poor families also depends on the budget. Education expert Manish Mohta, founder of Learning Spiral, has suggested how the burden of studies on the middle class can be reduced. Many possibilities have been expressed regarding the education sector, which can happen in Budget 2026 and can change the future of students and parents of every category.

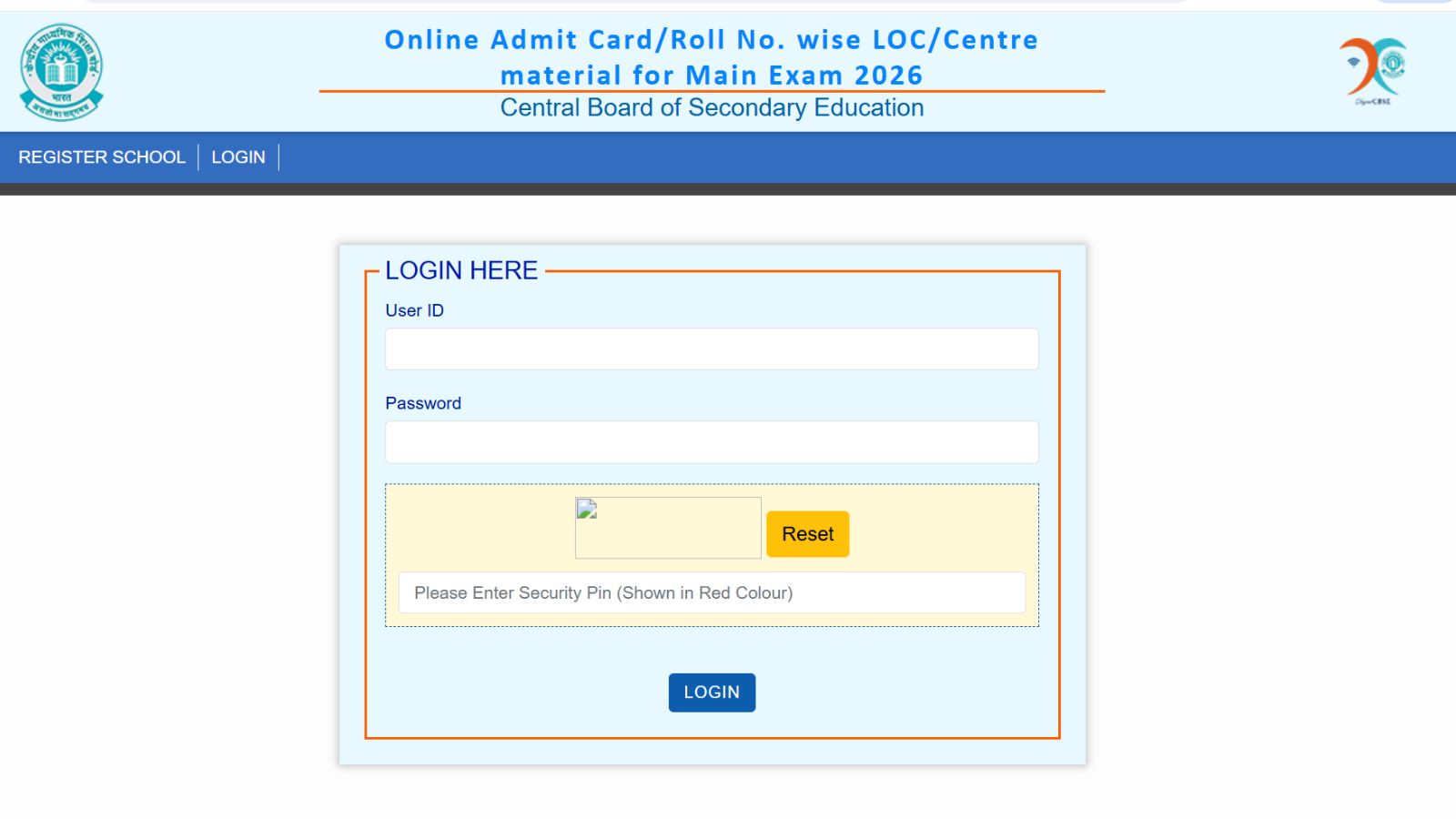

Budget 2026 Education LIVE Updates: See important information here

Education has long been considered the most effective path to social progress for the middle class in India. However, over the past few years, the costs associated with getting to this point have increased significantly. Rising education costs include a wide range of expenses – primary and secondary school fees, as well as college/university tuition fees. Because of this, many people in the middle class are facing financial troubles because they are unable to meet the criteria of many public welfare systems and they lack financial resources compared to wealthier families.

As people prepare for Budget 2026, an important question that needs to be answered is whether the Budget will be able to reduce the burden on middle-class families or will the relief be only nominal.

education is becoming expensive

One important thing about the current environment is that ‘education inflation’ is no longer an issue limited to private elite institutions only. Now, with the recent introduction of self-financed seats and examination fees in government colleges, the amount of money families are spending on education in self-location education hubs has increased significantly. Apart from this, private universities and coaching centers are continuously increasing their fees on the basis of implementing new technology or improving the infrastructure. Therefore, Budget 2026 should address the issue of affordability across the entire education ecosystem and not just at the fringes of the issue.

investment in public sector

Increasing the level of funding and expanding the scope of public sector investment (public universities/colleges) could have a major impact on these issues. More public sector facilities will increase capacity and thus reduce demand for expensive private sector facilities for middle class students. More public sector funding will increase the number of full-time faculty and students, and will also provide the necessary infrastructure (labs, hostels, digital infrastructure) to provide quality education to more students without compromising on standards. With higher capacity at state universities and colleges and more regional centers, regional students will be less likely to have to travel far from home to attend university, saving hundreds (or thousands) of dollars each year in rent and living expenses, which typically make up a large portion of the total cost of university.

Student loan subsidy

Additionally, student loan debt has become a major cause of stress for many middle-class families. In the past, student loans gave students the opportunity to attend college and repay the loan over time. But, in recent years, student loans have become a major financial burden on borrowers. Student loans have high interest rates, limited repayment plans, and few tax benefits, which place significant financial stress on families even before the borrower finds a stable job after college graduation. Budget 2026 is likely to explore ways to introduce special interest rate subsidies for middle-income families, offer longer repayment periods for students, or implement an income-based repayment model to immediately reduce the financial stress on families and eliminate the possibility of lifetime debt associated with educational expenses.

tuition fees

Another aspect of practical help from Budget 2026 is tax policy. The current deduction for tuition payments does not reflect the true cost of education today. Increasing the deduction limit and/or including more types of education, such as skills-based training, test preparation, and online learning, would have tangible benefits for working families. Although the tax relief does not directly reduce tuition fees, it does help reduce some financial stress during the crucial years of study.

Cost regulation and transparency, especially regarding fees charged by private institutions, is another area that Budget 2026 should focus on. Although strict fee regulation may deter investment, there is a need for a framework for transparent fee increases. Publishing all fees charged, linking fee increases to quality measures, and improving regulatory monitoring will reduce arbitrary fee increases. This will provide families with an idea of the estimated costs and rebuild confidence in the private education industry.

scholarship program

Financial aid/scholarships are another area that should be re-evaluated. Currently, most financial aid and/or scholarship programs are either for the economically disadvantaged or for high-performing students, leaving a large portion of the middle-income population without assistance. Developing merit-plus-income scholarships targeting the middle class, especially in more expensive professional/technical courses, can help solve this problem. Providing tuition assistance or conditional grants can make a big impact on families.

The 2026 budget proposal may reduce some of the expense-related stress faced by many families of students pursuing higher education, but this can happen only if both the central government and the states implement it through smart policy planning, otherwise, any relief provided to these families will be very little. What we want to see this time is more action than just promises in the Federal Budget 2026, including significantly more public investment, more reforms to help borrowers succeed with education loans, more tax incentives for school-going students and government support for children in families hit hard by inflation.