Trade relations between the US and India have recently taken a dramatic turn. US President Donald Trump has announced a reduction in tariffs (import duty) on Indian goods, but it is believed that there is a big condition attached to it – and that condition is to stop the import of crude oil from Russia. This activity has taken place at a time when Western sanctions on Russia are becoming more stringent and the economy there is under immense pressure. Let us understand this entire matter through answers to some important questions.

Question: What changes has America made in the tariff for India and what condition has been kept in return?

answer: US President Donald Trump has agreed to reduce the tariff on goods imported from India from 25% to 18% on February 3. Apart from this, he also on Friday removed the additional 25% tariff imposed on the continued import of Russian oil. President Donald Trump says that this decision was taken because Indian Prime Minister Narendra Modi has agreed to stop the import of crude oil from Russia. This step is part of America’s broader strategy under which it wants to completely dry up Russia’s oil earnings so that its funding for the Ukraine war can be stopped.

Question: Has India officially confirmed to stop buying oil from Russia?

answer: There is still a contradictory situation on this issue. While on one hand President Trump has claimed that PM Modi has agreed to stop Russian oil, on the other hand Prime Minister Modi himself has not commented on it. When Union Commerce Minister Piyush Goyal was asked a question in this regard while announcing the details of the interim trade agreement with America, he avoided answering and said that the answer on this would come from the Ministry of External Affairs. However, what assurances have been given to the US on oil purchases from Russia? When this question was asked to the country’s Foreign Minister S Jaishankar, he also said that he was probably not suitable to ask this. On the other hand, Indian Foreign Ministry spokesperson Randhir Jaiswal responded diplomatically, saying that India’s strategy is to “diversify its energy sources based on objective market conditions”. This means that India will take decisions according to its interests. At the same time, data firm Kepler believes that India is not going to be completely separated from cheap Russian energy sources in the near future.

Question: Has the data shown any decline in Russian oil imports?

answer: Yes, the decline is clearly visible in the recent figures. Russian oil shipments to India have declined in the past few weeks, according to data from the Kyiv School of Economics and the US Energy Information Administration. This figure has declined from 2 million barrels per day in October to 1.3 million barrels per day in December. The decline shows that US pressure and sanctions are having an impact on trading decisions, even if not outright denied in official statements.

Question: What is the impact of these sanctions and declining oil exports on Russia’s economy?

answer: For Russia, oil exports have been a ‘cash cow’ that kept its economy afloat during the war, but now things are changing. Russia’s revenues have fallen to a multi-year low due to new punitive measures from the US and EU and US pressure on India. Russia’s tax revenues from oil and gas fell to 393 billion rubles ($5.1 billion) in January 2026, from 587 billion rubles in December and 1.12 trillion rubles in January 2025. This is the lowest level since the Covid-19 pandemic.

| month | import barrel per day | total barrel | value in dollars | Value (in Rs crore) |

| february 2025 | 1.48 | 41.44 | 2,838 | 23,839 |

| March 2025 | 1.87 | 57.97 | 3,971 | 33,356 |

| April 2025 | 1.96 | 58.8 | 4,028 | 33,835 |

| May 2025 | 1.95 | 60.45 | 4,141 | 34,784 |

| June 2025 | 2.1 | 63 | 4,316 | 36,254 |

| July 2025 | 1.6 | 49.6 | 3,400 | 28,560 |

| August 2025 | 1.7 | 52.7 | 3,610 | 30,324 |

| September 2025 | 1.62 | 48.6 | 3,329 | 27,964 |

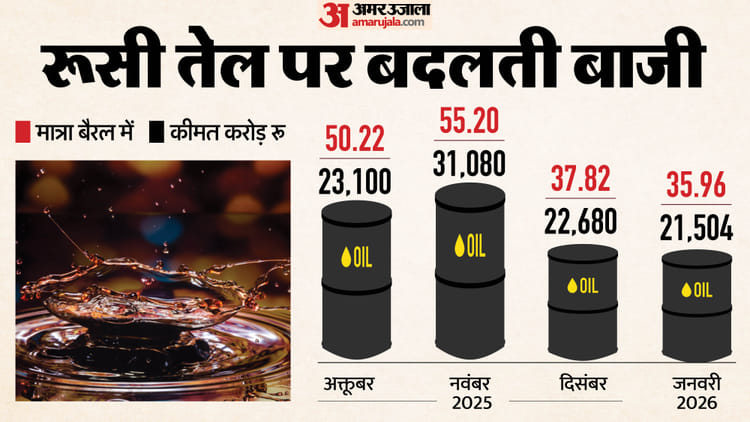

| October 2025 | 1.62 | 50.22 | 2,750 | 23,100 |

| November 2025 | 1.84 | 55.2 | 3,700 | 31,080 |

| December 2025 | 1.22 | 37.82 | 2,700 | 22,680 |

| January 2026 | 1.16 | 35.96 | 2,560 | 21,504 |

Note: Based on data released by the Ministry of Commerce and Industry and the Directorate General of Commercial Intelligence and Statistics.

Question: What impact has this had on Russian oil prices and discounts in the global market?

answer: Fearing tough US sanctions, buyers are now demanding huge discounts on Russian oil. In December this discount increased to about $25 per barrel. Russia’s main crude ‘Ural Blend’ fell below $38 a barrel, while international benchmark Brent crude was priced at around $62.50 a barrel. Since taxes on oil production in Russia are based on the price of oil, a lower price simply means less money coming into the Russian government’s coffers.

Question: What steps is Russia taking to deal with this economic crisis?

answer: To deal with declining oil revenues and slow economic growth, the Kremlin has resorted to raising taxes and borrowing. The Russian Parliament has increased VAT on consumer purchases from 20% to 22% and also increased levies on car imports, cigarettes and alcohol. However, experts believe that increasing taxes may further slow down the growth rate and taking loans may increase the risk of inflation. If this situation continues for 6 months or a year, Russia may be forced to reduce the intensity of the war and change its strategy on the front.