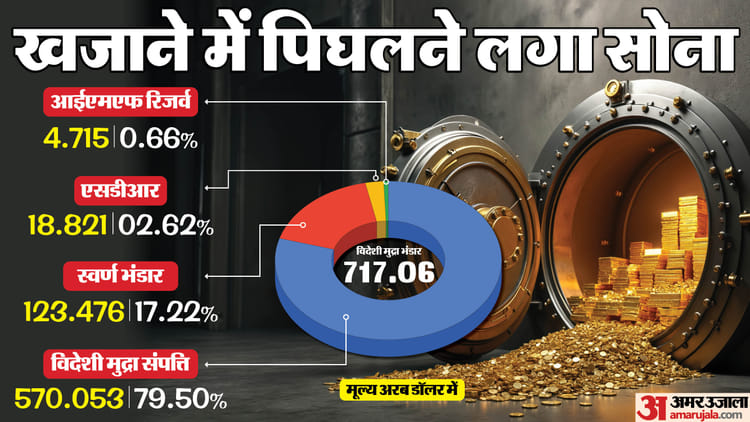

After last week’s historic rise, the foreign exchange reserves, which are considered a ‘protective shield’ for the Indian economy, have now registered a decline. According to the latest data released by the Reserve Bank of India (RBI) on Friday, the country’s foreign exchange reserves declined by $6.711 billion to $717.064 billion in the week ending February 6.

This fall is also significant because just last week the foreign exchange reserves had taken a massive jump of $ 14.361 billion and reached an all-time high of $ 723.774 billion. This decline in the latest data is mainly due to the huge decline in the value of gold reserves, while an increase in foreign currency assets has been seen.

Big drop in gold reserves

Analysis of RBI data shows that the main reason for the decline in total reserves is the decline in the valuation of gold reserves. During the week under review, the value of gold reserves declined by $14.208 billion to $123.476 billion. This is a big correction which reflects the fluctuations in gold prices in the global markets.

surge in foreign currency assets

Interestingly, despite the decline in total reserves, its largest component i.e. foreign currency assets (FCA) has strengthened. FCA rose by $7.661 billion to $570.053 billion in the week ended February 6.

Foreign currency assets expressed in dollar terms include the effects of movements in non-US currencies such as the euro, pound and yen, which are held in foreign exchange reserves. This means that the dollar’s movement against other major global currencies has supported this component.

Condition of SDR and IMF registers

RBI has also shared data on other components:

- SDR: Special Drawing Rights (SDR) declined by $132 million, bringing it down to $18.821 billion.

- IMF position: India’s reserve position with the International Monetary Fund (IMF) also declined by $32 million to $4.715 billion.

Fluctuations in foreign exchange reserves on a weekly basis are a normal process, which mainly depends on the volatility in the global currency market and the interventions made by the RBI to manage the rupee. While the $6.7 billion decline may seem large, the $717 billion level is still a strong buffer for the Indian economy, enough to cover almost a year’s worth of imports.