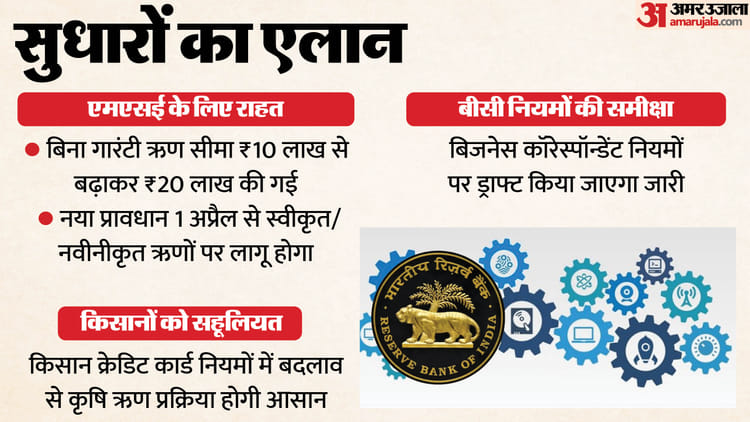

Reserve Bank of India Governor Sanjay Malhotra has announced to increase the collateral-free loan limit for micro and small enterprises (MSEs) from ₹10 lakh to ₹20 lakh. This step has been taken with the aim of improving access to formal credit, encouraging entrepreneurship and strengthening last mile credit delivery.

This provision will be applicable to all MSE loans sanctioned or renewed on or after April 1, 2026, the Governor said during the sixth and final bi-monthly monetary policy review of the current financial year on Friday. Detailed instructions in this regard will be issued soon.

Review of Rules on Business Correspondents

He said that Business Correspondents are playing a very important role in providing banking and financial services to villages, remote and deprived areas. To better understand and improve their working arrangements, a committee of officials from the Reserve Bank of India, Department of Financial Services, Indian Banks Association and National Bank for Agriculture and Rural Development was formed. The rules are being reviewed based on the recommendations of this committee. RBI will soon release the draft of the proposed changes in these rules for public opinion, so that all parties can give their suggestions.

Changes proposed in Kisan Credit Card (KCC) guidelines

RBI has also undertaken a comprehensive review of the KCC scheme to increase coverage, simplify operations and address new needs. The proposed changes include standardization of crop seasons, extending the KCC period to six years, fixing drawing limits in line with the Scale of Finance (SoF) for each crop season and subsuming expenses related to technical interventions. These draft guidelines will also be released soon. These initiatives are expected to increase credit flow to MSEs and agriculture sector, boost financial inclusion and strengthen the reach of banking services at the grassroots level.