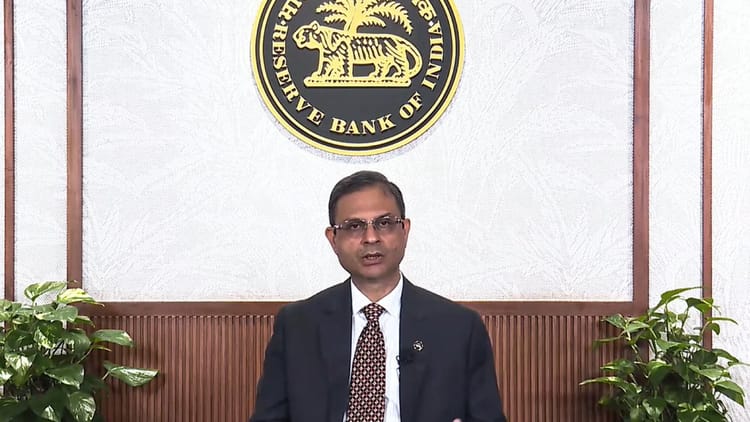

The decisions of the monetary policy review meeting to be held at an interval of two months were announced by the Reserve Bank of India on Friday. RBI Governor Sanjay Malhotra said that the Monetary Policy Committee (MPC) has not made any change in the interest rates. However, the forward stance of the central bank is a great relief for the borrowers.

RBI Governor Sanjay Malhotra has made it clear that interest rates will remain at low levels for a long period and they are expected to go down further in the future. MPC has kept the repo rate unchanged at 5.25% and has maintained its stance ‘neutral’. Let us know what the RBI Governor emphasized.

Rate cut cycle and impact on FD investors

“Policy rates will remain at low levels for a long time and may go even lower,” Governor Malhotra said. However, he also added that the final decision on rates will be taken by the MPC only.

According to RBI data, since February last year, the central bank has reduced the repo rate by a total of 125 basis points. The Governor admitted that the impact of the cut in policy rates on the deposit side has been slow. He indicated that interest rates on fixed deposits will go down in the coming times, which may become a cause of concern for investors dependent on fixed income.

‘Booster dose’ of GDP and trade agreements

RBI’s outlook on the economy front is positive. The central bank has revised and raised the GDP growth rate estimates for the first and second quarters of the next financial year. Responding to a question on the impact of recent trade agreements signed by India, the Governor said that these agreements, combined with other factors, could contribute up to 20 basis points to the country’s GDP growth.

Government borrowing and foreign investment

Allaying market concerns over post-Budget government borrowing, Deputy Governor T Rabi Shankar said the RBI will manage the government borrowing program with ease.

- The government’s gross borrowing for the next financial year is estimated at Rs 17.2 lakh crore.

- Net borrowing is estimated to be Rs 11.73 lakh crore.

Governor Malhotra said treasury bills will help manage the yield curve and the government will be able to raise its borrowings at reasonable rates.

Investment and currency situation

On the announcements made in the budget regarding data centers, the Governor said that this is expected to bring foreign investment on a large scale in the country. While talking about the trend of cash, he said that there has been a significant increase in ‘currency in circulation’ in the last one year.

This policy review of RBI shows that the focus of the central bank is still on supporting growth. While the hope of reducing EMIs for borrowers remains, depositors will have to be prepared for a period of falling interest rates.

The shine of gold and silver increased the heat

For the first time, RBI has clearly admitted that prices of precious metals are now playing an important role in shaping inflation. According to the MPC statement, the modest increase in the inflation outlook of about 60-70 basis points (0.60-0.70%) is attributable only to the rise in precious metal prices.

Even after falling by 1.24% on Thursday, gold closed at a high of Rs 1,48,860 per 10 grams. The RBI noted that amid global uncertainty and geopolitical tensions, investors are turning to gold as a ‘safe-haven’, keeping its prices at record levels. Even though headline inflation estimates have been raised, the internal inflation situation appears to be under control. Core inflation, i.e. if gold and silver are removed, the core inflation remains stable at 2.6% (as per December data).