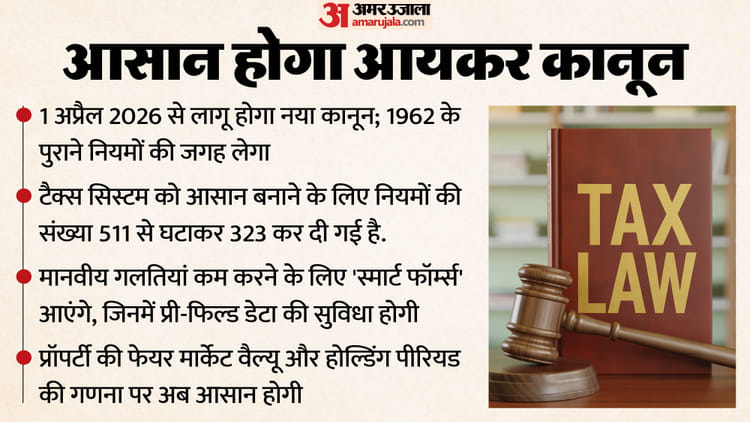

The Income Tax Department has taken a big step towards simplifying and modernizing the tax system in the country. The government has released the draft of ‘Income Tax Rules, 2026’, which will give effect to the new Income Tax Act, 2025, which will come into effect from April 1. These new rules aim to simplify the tax filing process, including a huge reduction in pre-filled forms and paperwork.

Major changes have been proposed in the draft regarding the use of PAN card, list of metro cities for HRA and crypto transactions. After public opinion, the final notification will be issued in the first week of March.

Understand here in simple language the main points of the draft and what effect they will have on you:

1. Huge reduction in paperwork and forms

The number of rules has been reduced to make compliance easier for taxpayers.

- The existing 511 rules have now been reduced to only 333.

- Similarly, it is proposed to reduce the number of tax forms from 399 to 190. This will make filing returns faster and more convenient than ever before.

2. New limitations on use of PAN card

The limits regarding mandatory requirement of PAN card in transactions have been amended:

- hotel bill: Now it will not be necessary to give PAN on payment of hotel bill of less than Rs 1 lakh.

- Purchase of vehicle: While purchasing a two-wheeler or four-wheeler, if the price is more than Rs 5 lakh, it will be mandatory to provide PAN.

- Property: In case of immovable property, if the value is more than Rs 20 lakh, it will be necessary to quote PAN.

- Cash Transactions: It will be mandatory to provide PAN for cash deposits or withdrawals of more than Rs 10 lakh in a year.

- Insurance: PAN has been made mandatory for having an account-based relationship with insurance companies.

3. Relief in HRA and allowances for employed people

There is some good news in the draft for the salaried class:

- HRA scope increased: Bengaluru, Pune, Ahmedabad and Hyderabad have also been included in the list of ‘metro cities’ for calculating House Rent Allowance (HRA). With this, employees living in these cities will be able to get more tax exemption.

- Tax-Free Facilities: The tax-free limit on facilities like official vehicles and free meals has been increased, leaving more money in the hands of employees.

4. Strictness and acceptance on crypto and digital currency

Rules have also been clarified to regulate the digital economy:

- Crypto Exchange: Now crypto exchanges will have to mandatorily share information with the tax department. This will increase monitoring of crypto transactions.

- CBDC: Central Bank Digital Currency (CBDC) will be recognized as an acceptable mode of electronic payment.

The new rules will replace the old income tax rules of 1962. The government aims to notify the final rules by the beginning of March so that a transparent and simple tax regime can be implemented from the new financial year (April 1).